Free After Tax Wage Calculator

Easily calculate your take-home pay with our Free Post Tax Wage Calculator for New Zealand and Australia. Get a quick estimate of your after-tax income based on the latest tax rates, and find out exactly how much you’ll earn each week, month, or year. Perfect for budgeting, salary negotiations, and financial planning!

How to use the post tax wage calculator

This calculator works best on desktop. To view on mobile, please zoom out on your browser

Free After Tax Wage Calculator

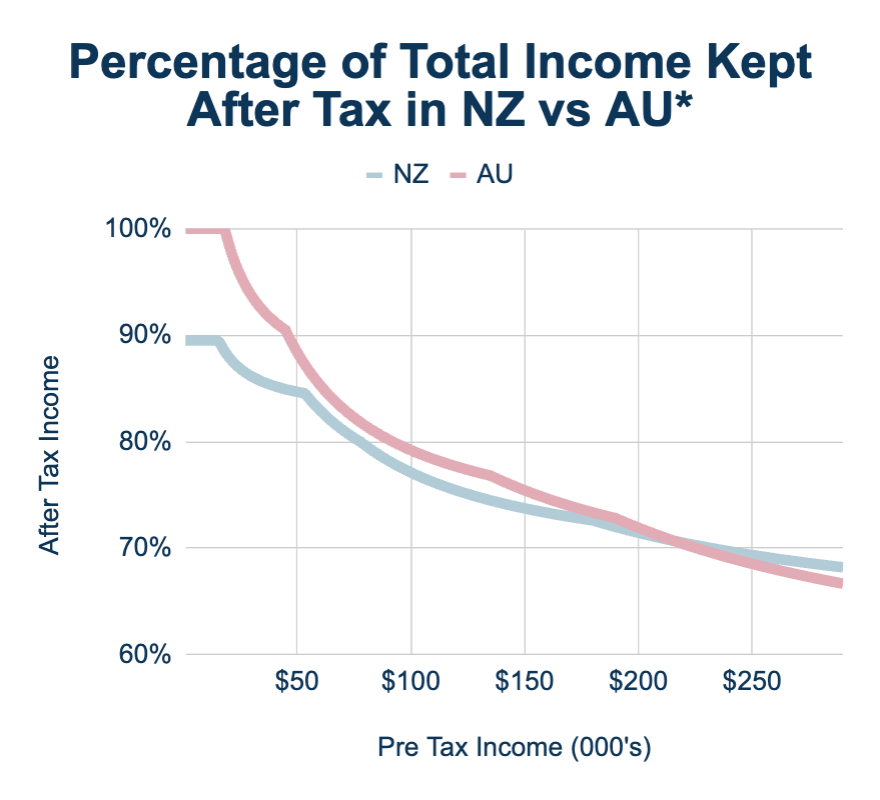

The Verdict

When accounting for only progressive tax rates, if you earn less than $216,000 then you might be better off in New Zealand but if you earn more than $216,000 then you might be better off in Australia.

Disclaimer

Please note that this tool is intended as a guide only. The Post Tax Wage Calculator uses progressive tax rates based on general thresholds for New Zealand and Australia to estimate post-tax income. The calculation assumes no additional deductions, exemptions, or rebates that may apply to individual circumstances. For example superannuation, ACC, student loan deductions, etc.

These calculations are simplified estimates and should not be relied upon for making financial or tax-related decisions. We do not guarantee that the results of this calculator will be accurate for your specific situation, and we recommend consulting a financial or tax professional for precise advice.

Looking for a way to automate your staff timesheets?

Timecloud Timesheet software takes the stress out of staff timesheets, generating them automatically and integrating seamlessly with your payroll.

Timecloud's accounting and payroll integrations include Xero, Quickbooks, Myob, iPayroll, SmoothPay, Crystal Payroll, SmartPayroll and many more.