The Fair Work Commission Announcement: How Businesses Can Prepare

The Fair Work Commission announcement will bring big changes to businesses throughout Australia. The national minimum wage and all modern award minimum wage rates will increase by 3.75%, starting on July 1, 2024. This decision came after a review of living standards, the needs of low-paid workers, and the goal of achieving gender equality.

Impact of the Wage Increase on Award-Reliant Employees and Australian Businesses

The FWC recognises many employees’ cost-of-living pressures, particularly those in low-income households. The increase aims to relieve some of this stress while balancing the overall economic situation. This change will impact about 2.6 million employees and indirectly affect countless others.

Additionally, the FWC is set to address gender undervaluation issues in certain modern awards. They’ll examine and correct pay discrepancies for many sectors. These include early childhood education, disability care, social services, and healthcare.

Jason Ennor, co-founder and CEO at MyHR, emphasizes the importance of preparation for businesses:

“Given their scope, all employers are affected in some way by rises to the minimum wage, not just those employing award-free, minimum-wage workers. Businesses need to be proactive in preparing for this wage increase. This includes reviewing payroll and budgeting, communicating with employees, considering the impact on non-award employees, and reviewing employment contracts and policies.”

Ensuring a Smooth Transition

So to help you steer these changes from the Fair Work Commission announcement, we’ve compiled a business preparation checklist outlining key action steps:

- Make sure you review payroll and budgeting:

- Update payroll systems to reflect the new wage rates.

- Adjust budgets to accommodate increased labour costs.

- Have good communication with employees:

- Inform employees about the upcoming wage increase and its effective date.

- Clearly explain how the increase will be reflected in their pay slips.

- Consider non-award employees:

- Assess potential compression issues where non-award employees earn close to the new minimum rates.

- Consider adjustments to non-award salaries to maintain internal equity.

- Review employment contracts and policies:

- Ensure all employment contracts and company policies comply with the new minimum wage rates.

- Make necessary updates to reflect the changes.

Leveraging Workforce Management Software for Australian Businesses

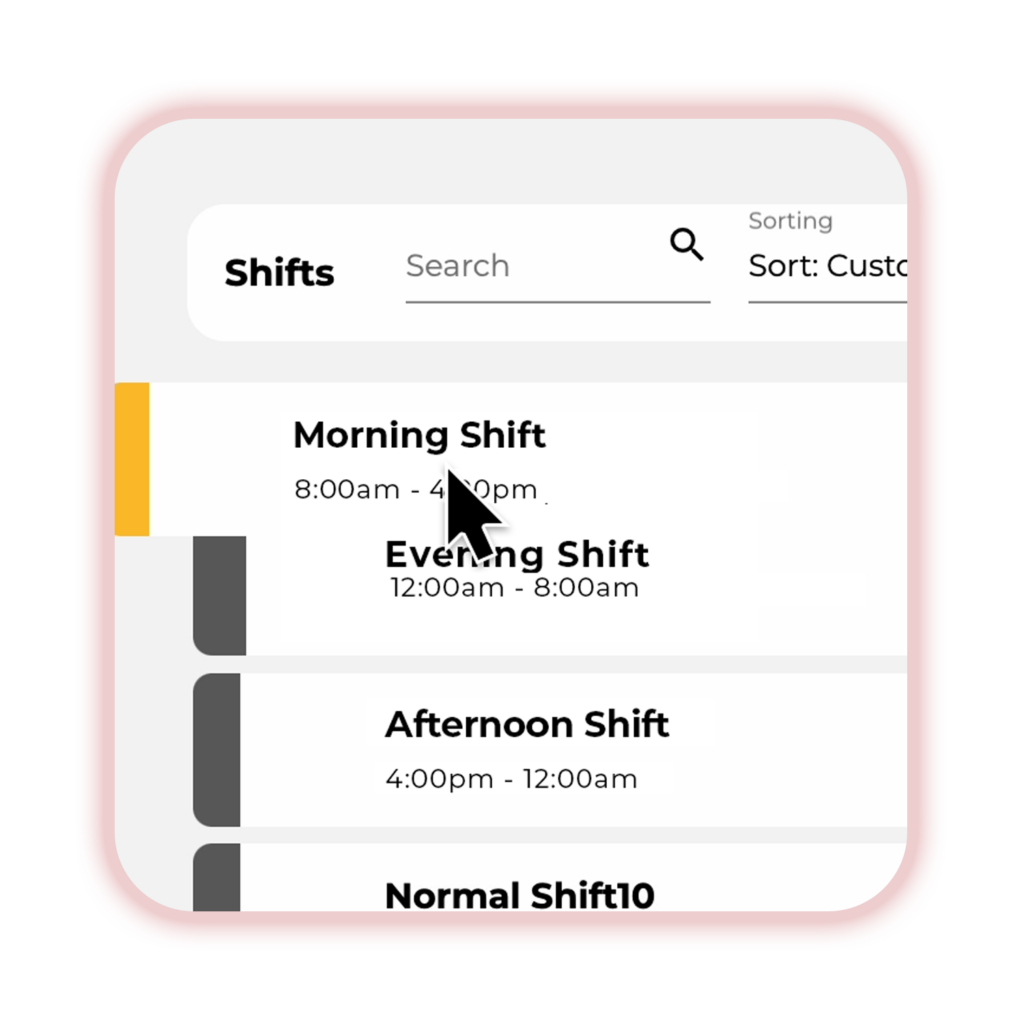

However, one way to simplify the challenges coming from the Fair Work Commission announcement is to implement workforce management software. Using a system like Timecloud can greatly streamline payroll processes and ensure compliance. Using one platform to track employee hours, manage awards, and automate payroll ensures employees are paid correctly, especially during minimum wage adjustments. Additionally, these tools can help identify and address potential issues with award classification and pay equity.

Key Benefits of Workforce Management Software:

- Simplified Award Management: Consolidate award data and ensure accurate application of award rates.

- Automated Payroll Processing: Reduce errors and streamline payroll calculations.

- Improved Compliance: Stay updated on regulatory changes and ensure compliance with FWC rules.

- Enhanced Efficiency: Free up time and resources by automating administrative tasks.

The upcoming minimum wage increases will have a far-reaching impact on virtually all businesses across Australia, so it’s essential to be ready for the changes. Take control of the upcoming wage increase by exploring how Timecloud can enable you to uphold compliance, promote a seamless workflow, and help you reassure employees that they’re receiving their rightful compensation.