Combating Payroll Errors – How Do You Make Sure You Get It Right?

Why Do Payroll Errors Happen?

It’s easy to make mistakes when keeping up with changing labour laws, tax rules, and award interpretations. After all, we’re only human. Catching discrepancies without real-time data and comprehensive reporting can be challenging – and even then, if you don’t have software or systems that integrate together, errors can multiply as data moves between them.

The Hidden Costs of Payroll Errors

Governments take wage regulations seriously and impose hefty fines on companies that don’t comply. If you make a mistake in payroll, you may be responsible for reimbursing employees for underpayments, even if the errors were unintentional.

Worse, payroll mistakes can harm your company’s reputation and employee morale. News of payroll issues can erode public and employee trust, which can damage your brand. When workers feel they aren’t being compensated fairly, it leads to dissatisfaction and decreased productivity.

Combating payroll errors can be time-consuming and distracting, taking you away from essential business activities. To avoid these issues, it’s essential to stay on top of payroll and ensure accuracy.

The Power of Integration: Time and Attendance + Payroll

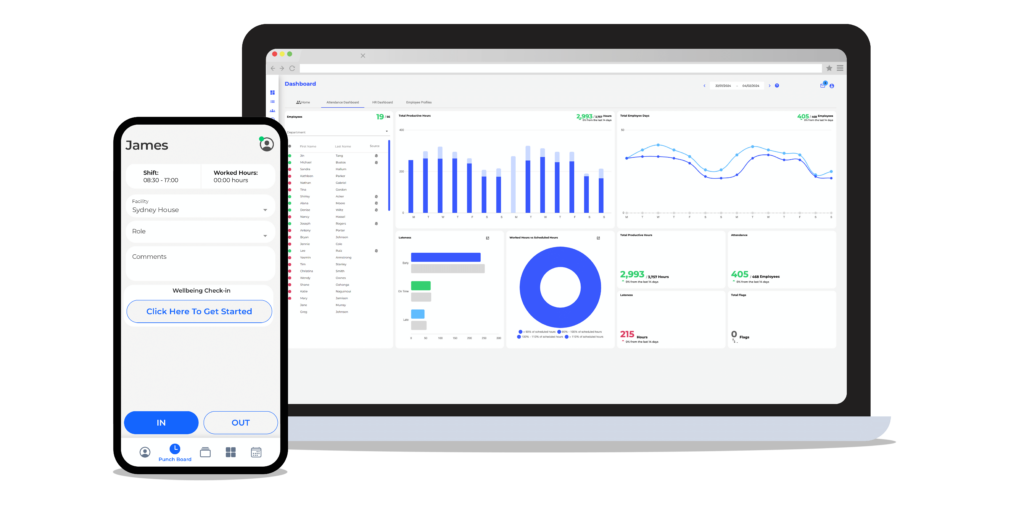

One of the most effective ways to combat payroll errors is to invest in a time and attendance software solution that seamlessly integrates with your payroll system. Here’s why this is crucial:

- Eliminates Double Entry: Time data flows directly into your payroll system, minimizing manual input and the potential for typos.

- Enforces Complex Rules: The software automatically calculates pay based on tracked hours, factoring in overtime, leave entitlements, and specific award rules.

- Increases Accuracy: Automation significantly reduces the risk of human error, ensuring employees are paid correctly.

- Saves Time and Money: The streamlined process frees up HR staff and prevents costly overpayments or the need for later corrections.

- Provides Real-time Insights: Spot potential overpayments or anomalies before they hit your paycheck.

Prevention is the Key: Additional Strategies

While investing in integrated time and attendance software is a crucial step, it’s just one piece of the payroll accuracy puzzle. Here are some additional strategies to consider for further strengthening your processes and minimising the risk of costly errors:

- Regular Audits and Reviews: Schedule regular payroll audits to catch potential errors early.

- Employee Education: Ensure employees understand how to record their time correctly and how their pay is calculated.

- Seek Professional Support: Consider outsourcing your payroll if it’s becoming too complex.

Payroll accuracy is crucial for businesses to avoid costly fines and protect their reputation, and an integrated time and attendance software such as Timecloud can help you with combating payroll errors, so you can avoid the same mistakes as we recently saw hit the headlines.

Want to see seamless Time and Attendance in action? Reach out to our team today.